IRS Updates

Scammers Target Tax Pros with Fake Software Update Email

(CPA Practice Advisor) - The IRS is warning tax pros that scammers are now using fake emails that pretend to be from tax software providers and tries to trick recipients into clicking on a bogus software update link.

CPE Standards Update Accommodates New Forms of Learning

(JofA) - CPAs will be able to receive continuing professional education (CPE) credit for instruction received in nano-learning and blended learning platforms under new standards issued Tuesday.

How to Recover a Lost or Corrupt Document in Microsoft Word 2016

(How-to-Geek) - Have you ever had a troublesome .doc or .docx file Word that you can’t seem to open? Or even lost a document completely, with all your hard work gone with it?

Man Shocked To Receive Tax Notice Advising He Might Owe Trillions

(Forbes) - Although we are changing your tax code you may still not pay enough tax by 5 April 2017. We think the amount you owe HMRC is £14,301,369,864,489.03.... Hembrough said that it would take him 369 million years to pay off that much in tax on his current salary.

Ford to offer self-driving cars without steering wheels by 2021

(Computer World) - The autonomous vehicles would be for ride-hailing or ride-sharing services; vehicles for consumers would come later

(CPA Practice Advisor) - The IRS is warning tax pros that scammers are now using fake emails that pretend to be from tax software providers and tries to trick recipients into clicking on a bogus software update link.

CPE Standards Update Accommodates New Forms of Learning

(JofA) - CPAs will be able to receive continuing professional education (CPE) credit for instruction received in nano-learning and blended learning platforms under new standards issued Tuesday.

How to Recover a Lost or Corrupt Document in Microsoft Word 2016

(How-to-Geek) - Have you ever had a troublesome .doc or .docx file Word that you can’t seem to open? Or even lost a document completely, with all your hard work gone with it?

Man Shocked To Receive Tax Notice Advising He Might Owe Trillions

(Forbes) - Although we are changing your tax code you may still not pay enough tax by 5 April 2017. We think the amount you owe HMRC is £14,301,369,864,489.03.... Hembrough said that it would take him 369 million years to pay off that much in tax on his current salary.

Ford to offer self-driving cars without steering wheels by 2021

(Computer World) - The autonomous vehicles would be for ride-hailing or ride-sharing services; vehicles for consumers would come later

FAQs about Affordable Care Act Implementation Part XI

Premium Tax Credit:

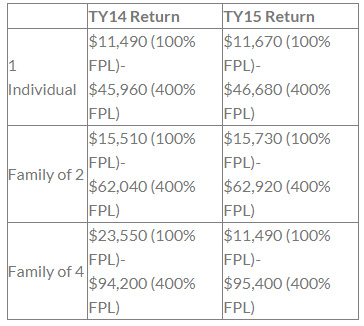

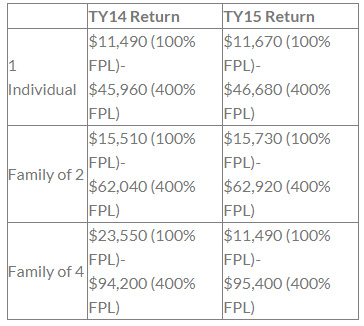

Federal Poverty Level

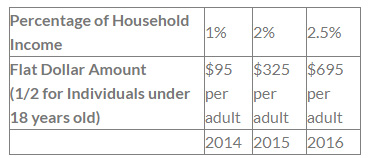

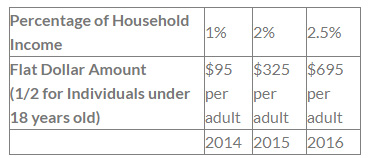

Phase-in of Penalty

The following source domuments will be used to support ACA computations starting 2015 tax year

- Form 1095-B Health Coverage Statement

- Form 1095-C, Employer-Provided Health Coverage Statement

- No Changes for Form 1095-A

Form 1095-B

Health Coverage Statement

- Issued by a government-sponsored program, eligible employer-sponsored plan, individual market plan or miscellaneous coverage plan

- All employers that provide self-insured health coverage to their employees are treated as coverage providers

- Information about whether taxpayer, spouse and dependents had qualifying health coverage for some or all months during year

- Individuals with minimum essential coverage not subject to individual shared responsibility payment

Form 1095-C

- Employer Provided Health Insurance Offer and Coverage Statement

- Employers with 50 or more full-time employees required to file Form 1095-C with employee and IRS

- Includes information about whether employer offered qualifying health coverage to employee, spouse and dependents for some or all months during the year

Small Business Health Care Credit

- Available to small businesses that offer insurance

- Help with cost of providing health care coverage for low and moderate income workers

- Maximum credit is 50% of premiums paid for small business employers and 35% for small tax- exempt employers

- Small employer must pay premiums on behalf of employees enrolled in a qualified health plan offered through a Small Business Health Options Program (SHOP) Marketplace

- Credit available to employers for 2 consecutive taxable years

USSC Rules on Marriage Equality

- All states now must license a marriage between two people of same sex

- Same sex married couples must file returns as married

- No longer have to file a married return for federal purposes and 2 individual returns in state that didn't adopt same sex marriage

- We're not sure if domestic partnerships and civil unions will fade away (these were marriage subsistutes)

Direct Deposits of Refund to a myRA® Account

- Starter retirement account offered by Department of Treasury

- Can have refund directly deposited to new retirement savings program called myRA®

- Must already have a myRA® account

- For more information and to open a myRA® account online, visit

myRA| my Retirement Account

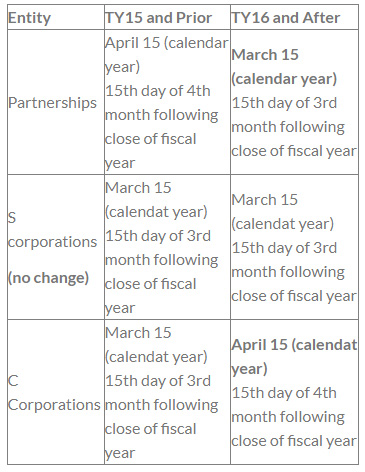

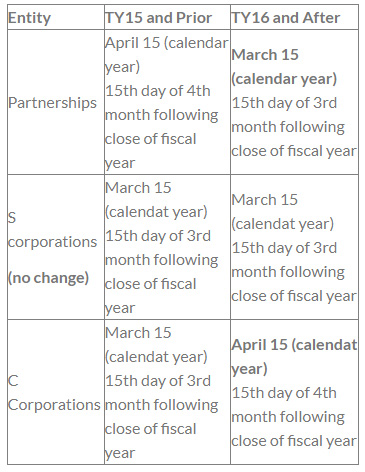

Adjusted Filing Deadlines for TY16

- C corporations with tax years ending on June 30, current filing date (September 15) remains in effect until TY beginning after 12/31/25 and will be extended to October 15 thereafter

- Calendar year C corporations: automatic extension is 5 months (September 15) until TY beginning after 12/31/25, then extension is increased to 6 months (October 15)